You can learn about your business’s health by just looking at how money is moving through it. Is there any surplus money? Are you just in the break-even position? Or, are you losing money out of your pocket to run the business? To get a clear answer to such movements of money, you need to learn how to calculate profit margin. If you rely on others to compute profits, you might be in a problem. Because those on whom you rely can siphon off money from your venture. Therefore, besides running the business operations, you also need to be smart enough to understand metrics that evaluate your company’s performance and scope for future growth. To help you, we have compiled the ultimate resource that helps you understand various types of profit calculations and their formulas. Furthermore, we have also listed some trusted and reliable calculator tools that you can use in your business.

What Is Gross Profit Margin?

It is the simplest form to compute the profitability of any business that deals with sales. Because it gives out the profit as an income for your business that is remaining as cash. Businesses derive the gross profit margin after factoring in the cost of goods or services sold. Cost of Goods Sold (COGS) includes various input costs like product manufacturing, inventory management, shipping to the dealer’s site, shipping products directly to the customer, etc. While computing the gross profit margin by subtracting the COGS from total revenue, keep in mind that COGS will not include fixed costs, taxes, overhead costs, one-time costs, and debt. If you are starting from scratch, you can use the following formulas step-by-step to find the gross profit margin. Remember, you only need net sales and gross profit value.

Calculating Sales Revenue

It is necessary that the income be generated from the main line of business. For example, if you consider a car manufacturer, the amount earned from selling cars and accessories will be included in the revenue. However, if they make some additional amount by selling off old factory equipment, that will not part of the sales revenue.

Finding Gross Profit

Computing the Net Sales

Determining the Gross Profit Margin

What Is the Operating Profit Margin?

As you may have noticed from the above, the profit margin only counts for product/services-related expenditures, shipping costs, dealer discounts, etc. However, you are also losing out money on maintaining the business infrastructure. It is known as business operations cost. Thus, if you want to factor these expenses into your profit margin, the calculation becomes slightly complex. You need to carefully account for the administrative, operating, sales and marketing, day-to-day expenses, and overhead costs. Additionally, you also need to factor in the asset value depreciation of your company. While calculating the operating profit margin you need to keep out non-operational costs from the formula. These are taxes and debts that have no direct relation to the business operation. The calculation of this kind of profit margin needs a couple of information like COGS, revenue, operating expenses, etc. Here is a step-wise guide to calculating operating profit margin:

Determine the COGS Value

Every industry follows a similar formula to compute its COGS figure. However, the expense heads vary from industry to industry.

Calculating Operational Profit Margin

What Is the Net Profit Margin?

When anyone asks about the company’s profit margin, it is always the net profit margin. It is the most significant and practical computation of any business’s actual profit margin. Similarly, it is the most comprehensive and complex profitability calculation method. It indicates the total earnings left in your company’s account after accounting for all income streams. Besides the income, it also accounts for all the payments you have made towards business operations, COGS, and sales and marketing. Further, you can not accurately calculate your business’s capability to convert revenues into profits until you also include the following while calculating the profit margin:

All the one-time payments made on account of your businessAll other incomes like interests from deposits, bonds, and asset rentalsAll the taxes that you have collected either for goods and service tax (GST) or value-added tax (VAT)All the debt that you have in the market linked to your business operations

Calculating this value only requires the net profit amount and revenue. You already have the revenue figure from previous calculations.

Figuring Out the Net Profit

Computing the Net Profit Margin

Why Is Gross Profit Margin the Simplest Form for Representing Profit?

The gross profit margin calculation takes into account all the direct figures for revenue and expenses. It does not include any indirect costs or income related to your business. Hence, this value is easily available for analysis and evaluation of your business health. For quick trend analysis, most experts use this value to get an informative perspective on the business proceedings. Since all the values of gross profit margin are direct, if this value is going up over time, your business is profitable. On the contrary, if the gross profit margin is going down slowly, it means your business is no longer earning income as it is expending cash on running the organization. You need to focus on the sales practices, purchasing activities, usage of raw materials, and labor utilization. The gross margin percentage also lets you optimize your business, so that you can make maximum profit. For example, you can analyze several years of this value to find out if you are offering products or services at a lower cost than your competitors. It also indicates if your sales costs are higher than expected. Then, you can cut costs and increase product/service costs slightly to enhance net income. Additionally, when investors evaluate your business to purchase a stake in it, they also look at the gross profit percentage value. They use it to find out whether your business is capable enough to convert revenue into profit. So far, you have learned about the basic concepts of different ways that a business can compute its profit. Now, it is time to discover some advanced tools that help you automate these calculations:

Shopify Profit Margin Calculator

Shopify is one of the leading eCommerce platforms for millions of businesses worldwide. In addition to helping online venture entrepreneurs to set up their shops or service points, it also offers useful business tools and knowledgebases. One such tool is the profit margin computation system available online. The tool is simply a web app that you can access from any computer device that can run web browsers like Google Chrome, Mozilla, Edge, etc. Shopify’s website is based on the responsive web designing protocol and hence it also works on small screen devices like smartphones or tablets. If you are that person who is unable to determine how to price their products on eCommerce or offline stores, this is the right tool for you. The Shopify profit margin calculator will assist you in accurately discovering selling prices for your goods/services. Hence, you will be able to sell your produce at the right price, make your customers happy, and also earn a profit. The calculator’s user interface (UI) is pretty simple. It has primarily two sections. The upper section deals with data inputs and the lower section display the results. For example, you need to type in the Cost of Item ($) and Markup (%) when you need to identify a product’s selling price. The Cost of the Item ($) should be simple since you know the production cost. However, the Markup (%) may sound tricky, but it is not. Markup is simply the percentage of profit that you want from each sale of the item.

TimeCamp’s Profit Calculator

TimeCamp is a renowned time tracking solution for freelancers, solo entrepreneurs, and SMBs. If you are already using its services and do not want to shift focus to another software to find out the legitimate cost of your services or products, you can use its margin calculator. If you are not in this software ecosystem but still need a reliable solution to compute profit and revenue from cost and margin, you can use this tool for free. Similar to Shopify’s calculator, this one is also based on the cloud and accessible from any device with an updated web browser. To use this tool effectively, you need to know the cost of goods and services. Also, you need to decide a margin that you will need to input into the calculator app. Let us consider you sell gaming mice online. If it takes $100 to produce and deliver the gaming mouse to your customer, then you need to enter 100 in the Cost field. Now, if you want a 20% profit on the sales of the item, then enter 20 in the Margin field. As soon as you make both the inputs, you get the results. In this scenario, the Revenue is $120, and your profit from sales is $20. With the help of this tool’s data, you can also compute gross profit margin, net profit margin, and operating profit margin.

Finance Formulas’ Net Profit Margin Calculator

Finance Formulas is a popular destination for finance, banking, share market, corporate finance, and securities trading professionals for easy-to-use calculators. Also, these tools are free to use without any subscription or upfront payment. So, if you want to know how to calculate the net profit margin for your business, you can use one of its calculators. When you divide the net company income with total revenue or sales from products/services, you get the net profit margin. It has been discussed in detail earlier in this article. The value you get is always in percentage. This is the simple formula behind this online calculator. You input the Net Income and Sales/Revenues values in the tool interface. Next, the calculator automatically shows the net profit margin in percent form. It also shows the formula below the computing interface.

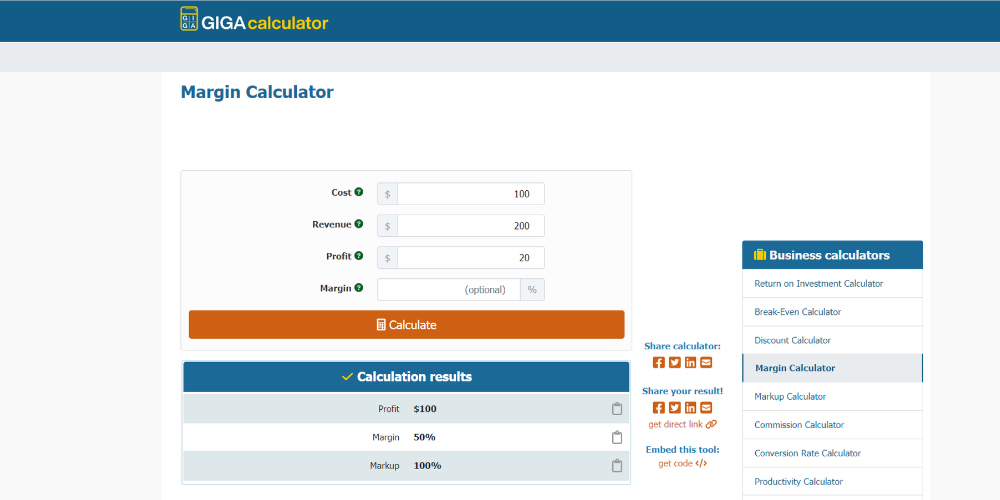

GIGAcalculator’s Margin Calculator

The Margin Calculator from GIGAcalculator is yet another popular tool that businesses use to find out a company’s profit margin. The tool is somewhat different since it calculates multiple types of margins in one user interface. All you need to do is input any two from Cost, Revenue, Profit, and Margin to compute the remaining two values. The followings are some definitions and variables used in this tool. Take a not of these to use the tool efficiently:

Cost: all-inclusive expense to deliver a good or provide a serviceRevenue: the gross value of operating revenue or income obtained from salesProfit: return from sales minus the cost from total revenueMargin: it is the percentage of profit that you keep from sales

Here is a list of data input and corresponding computational output from the tool:

Entering the cost and net/gross revenue will give out profit, margin, and markupGross/net profit and cost as input will deliver markup, revenue, and profit marginType in profit margin and cost to get markup, profit, and revenue

Final Words

Knowing how to calculate profit margin will help you a lot in the long run of managing a business and earning profit out of it. When you know the margin of profits, you can efficiently plan business spending, capital expenditures, hiring new staff, procuring new office assets, and so on. Moreover, whenever you go to deal with business investors, stakeholders, or big entities who want to buy your company, you need to present the business profit margin accurately above all other elements. We have gone through a simple discussion of various types of profit margins and their computations. We have also discussed some tools that can perform the profit margin calculation without any errors. From here on, you can take your business to the next step, grow your customer base, and happy selling! Here is another article that helps you manage your business with all-in-one platforms.